By Jennifer Storelli

When consumption habits changed almost overnight at the start of the pandemic, beverage-makers, distributors, retailers and consumers alike all scrambled to adjust. In many cases, direct-store-delivery technology made the difference of whether beverage brands could flex operations to ensure there was ample beverage stock wherever it was needed.

“Those who use DSD technology … help representatives get in and out of accounts faster to audit their position, pricing on the shelf and space in the overall account to understand what’s turning quickly and the trends of all brands,” explains Tim Hamm, market director for beer, wine and spirits for GoSpotCheck Inc., Denver. “This has helped them stay ahead of out of stocks and keep displays, shelves and coolers replenished as product has flown out the door in unprecedented volumes.”

He adds that suppliers and distributors that were not equipped with the right technology struggled to keep up with demand and lost sales opportunities as a result. If a beverage brand has enough distribution issues or starts to significantly lose market share within a given retail channel, it could lose its spot on the shelf, he points out.

Delivering visibility, success

Distribution

Distribution insights provide strategic advantages for beverage market

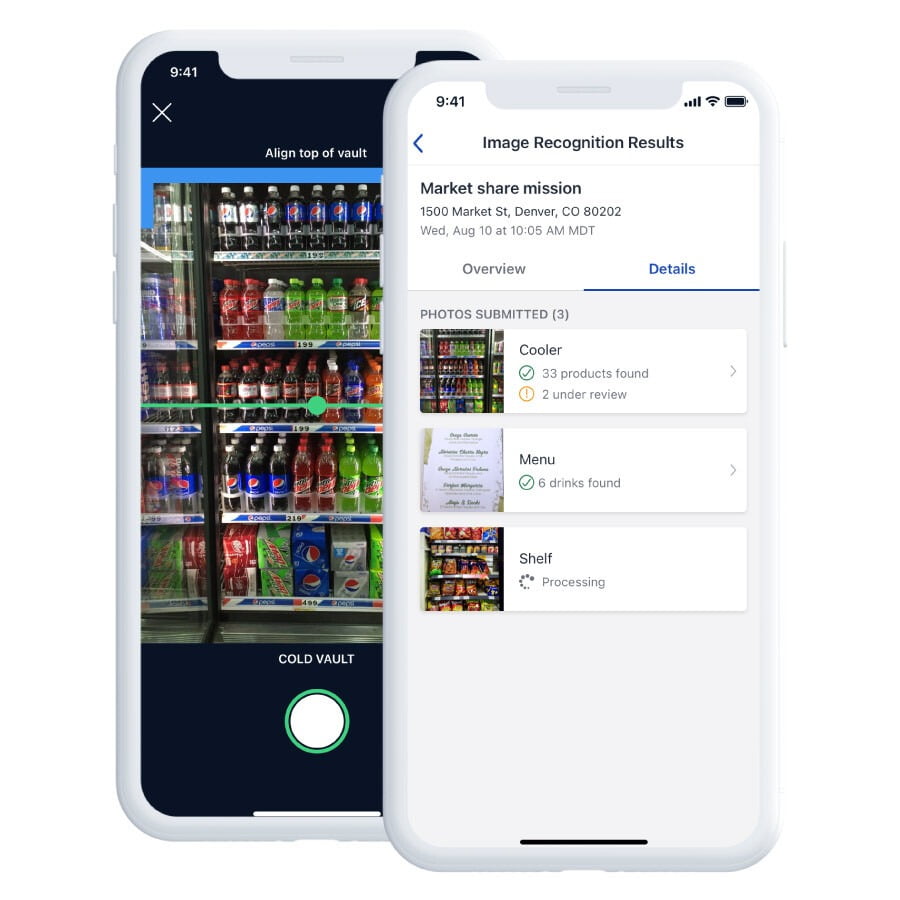

Image-recognition technology can help field representatives quickly assess the beverage assortment in a given retail location. (Image courtesy of GoSpotCheck Inc.)

“Once you lose your spot … you’re probably not going to get it back until another distributor or supplier slips,” he explains. “Unlike in grocery, you can’t pay slotting fees to win that space back. It’s about how well you manage your account and execute.”

In comparison, companies that utilize the latest DSD technology have greater real-time visibility down to the account level, can keep up with sales opportunities and retain their high-turn locations, and are even able to spot which competitor SKUs are chronically out of stock and help their clients pivot to take advantage of market opportunities, Hamm says.

Although beverage-makers have been working hard to avoid disappointing shoppers with yet another section of empty shelves in grocery stores, distributors have had to focus on keeping their workers in the field safe while still providing workers in the home office with the information they need to keep operations running. Mobile DSD solutions solve these challenges as well.

“Distributors needed reliable tools to get teams in and out of accounts faster and less frequently for health and safety reasons, [but still] collect the data they needed to manage the incredible demand increases,” Hamm explains.

“If distributors take the data they’ve collected during the pandemic, which represents the market changes we’ve seen in the last year, and use it to get high-turn products into on-premise accounts as they rebound, that will cement goodwill and trust for life. And in the end, that’s what it’s about.”

— Tim Hamm, market director for beer, wine and spirits for GoSpotCheck Inc.

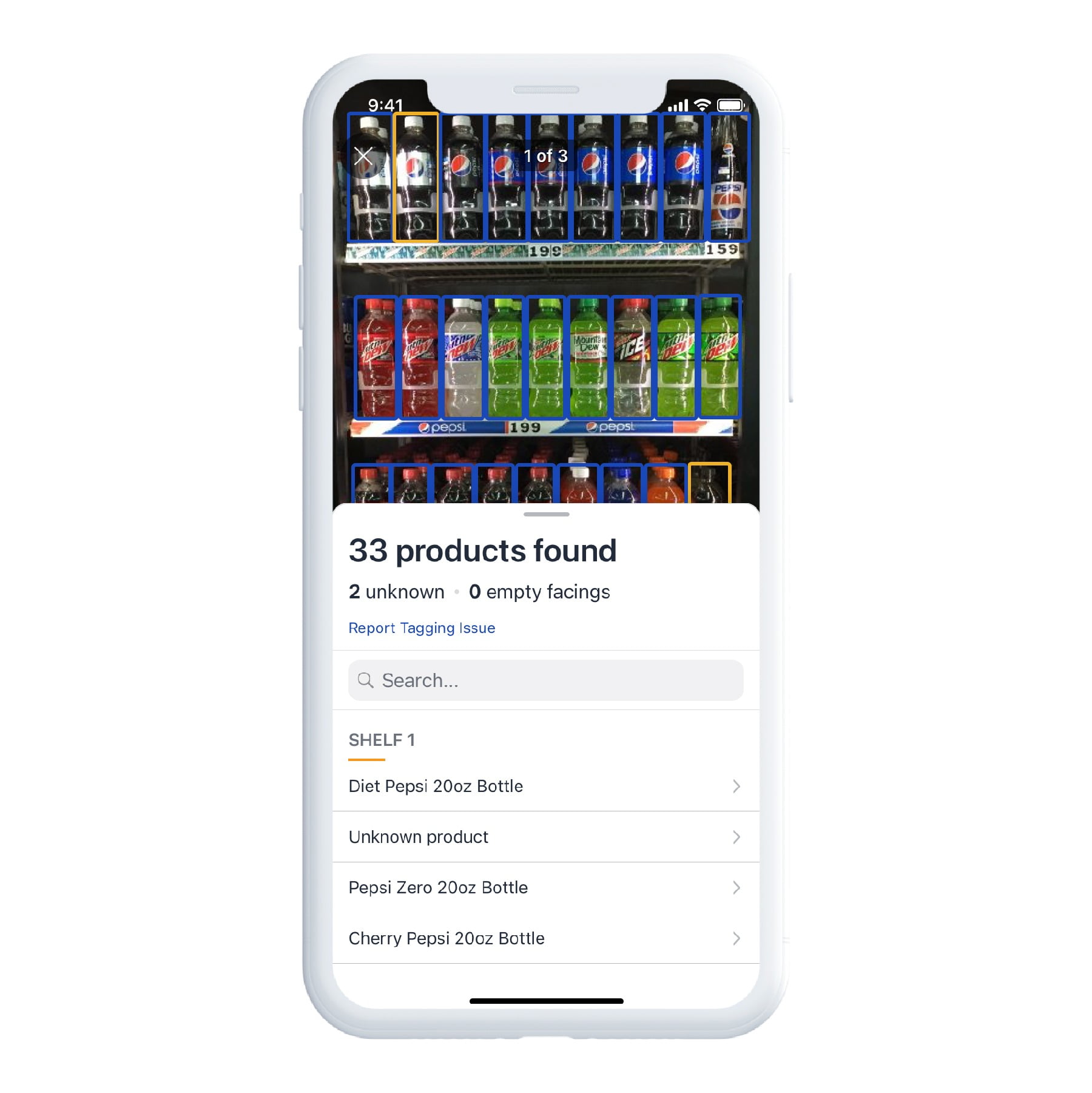

Image-recognition tools within DSD solutions can detect assets, identify products and segment categories found in an image of a cold box, cold vault, cooler or other product location, according to GoSpotCheck. The company’s image-recognition technology also can process granular insights about brand, category, supplier SKU count, assortment and percentage share and provide the field representative with relevant analytics in less than two minutes. GoSpotCheck reports that this technology has helped its customers reduce audit times by more than 50 percent.

A two-way street

Although DSD technology continues to evolve, in some ways the technology also is “devolving” based on market needs, experts note.

As the pandemic changed the way many companies do business, even more organizations turned to DSD technology to support a more eCommerce-friendly approach.

“eCommerce trends have significantly accelerated at every level of the industry,” explains Jake Sampson, vice president of sales and marketing for Encompass Technologies, Fort Collins, Colo. “We’re seeing suppliers, distributors, retailers and consumers adopt eCommerce at unprecedented rates. The COVID-19 pandemic has sort of been the key accelerator here, but it looks like [eCommerce is] here to stay.”

GoSpotCheck reports that its image-recognition technology has helped its customers reduce audit times by more than 50 percent. (Image courtesy of GoSpotCheck Inc.)

Encompass Technologies has been helping distributors successfully roll out online ordering for their customers to help the companies stay relevant at a time when consumers are increasingly turning to eCommerce to avoid contact with others.

Paul Hilton, food and beverage lead at Lincolnshire, Ill.-based Zebra Technologies Corp., adds that eCommerce trends have put more pressure on grocers and other traditional DSD channels.

“As grocery retailers are [setting] up their own online ordering systems, it’s requiring more visibility into their inventories to help ensure the products that consumers order are actually available for pickup and delivery in the timeframe that the grocer has set,” he says. “This can be difficult for grocery retailers or any DSD group that’s still leveraging pay-by-scan or scan-based trading.”

As a solution, these players are turning to older systems such as direct exchange and advanced ship notices to provide more accurate inventory visibility.

However, even companies that desire the more basic DSD technology need to keep up with evolving technical requirements within the telecommunications and software industries. For example, Microsoft stopped supporting its legacy mobile platforms, so DSD systems have switched to newer platforms like Android or iOS, Hilton says. Also, as carriers are reducing their 3G bandwidth to support 5G technology, DSD systems are making the switch to 5G networks.

Delivering data

These 5G networks bring along with them expanded access to real-time data, which beverage-makers can utilize in conjunction with existing data to improve sales forecasting and quickly pivot operations to adapt to demand, Zebra Technologies’ Hilton points out.

GoSpotCheck’s Hamm adds that data captured by DSD technology can foster compelling conversations among suppliers, distributors and retailers to determine how prices can be changed to better fit the market and what other opportunities are available to boost sales.

Right now, the industry is on the cusp of figuring out the full value of this actionable field data. “It will take some time for other areas of operations to be able to react in time to what the field is seeing, but that visibility and operational flexibility is very powerful,” Zebra Technologies’ Hilton says.

In the near future, experts predict that DSD technology could help the on-premise channel rebound faster. Encompass’ Sampson notes that bars and restaurants are rolling out online ordering technology to reduce in-person visits and avoid handling cash or checks. As more locations reopen and can increase their capacity for patrons, DSD data collected from other channels can help bar and restaurant owners be more strategic in their menu offerings.

“Right now, on-premise accounts are saying, ‘when I order from you and I can only serve at 25 percent capacity, I need people to drink what you’re selling me, so only sell me things you know will sell,’” GoSpotCheck’s Hamm explains. “If distributors take the data they’ve collected during the pandemic, which represents the market changes we’ve seen in the last year, and use it to get high-turn products into on-premise accounts as they rebound, that will cement goodwill and trust for life. And in the end, that’s what it’s about.” BI

April 2021 | bevindustry.com