Beverage

R&D

A sea change

By Lauren Sabetta

Weight management trends transform beverage landscape

(Image courtesy of Getty Images)

Rising to prominence through his Sweatin’ to the Oldies line of aerobics videos, flamboyant fitness personality Richard Simmons once described weight loss by saying, “The real pride, the real present, is your health and your longevity.”

Today, as consumers are increasingly connecting their weight to how they feel and function, experts note that attitudes toward weight loss have shifted to a weight-wellness approach, which encourages positive nutrition and exercise to support overall well-being.

Although fitness is important, eating a nutritious diet is consumers’ top approach to healthy living, ahead of watching their weight, says Carla Saunders, senior marketing manager at Cargill, Minneapolis.

“But increasingly, it’s less about control and more about making dietary choices that they believe will have a positive impact on health,” Saunders says. “Further, they’re not just looking to solve a singular need.

“They might buy a meal replacement drink for convenience — but they’re making the purchase to boost their protein consumption, provide satiation, promote weight management — and it better taste great, too,” she continues.

Paula Limena, vice president of global marketing for health and wellness at ADM, Chicago, echoes similar sentiments, noting that consumers’ modern approach to weight management has only heightened with more consumers seeking to lead an active lifestyle.

“These consumers are taking a holistic approach to their well-being and many are taking proactive steps to improve their long-term health … stating they want to ensure that they stay fit and active until as late in life as possible,” Limena says, citing FMCG Gurus’ “2022 Active Nutrition Regional Report.”

ADVERTISEMENT

Products showcasing prebiotics, probiotics and postbiotics are trending and opening doors for beverage manufacturers, ADM’s Paula Limena notes. (Image courtesy of Culture Pop)

Alongside a holistic approach, Limena points to consumers’ increasing awareness of the connection between a healthy weight and their metabolic health, in addition to seeing the gut as a root of wellness.

“Further, consumers are progressively aware of the importance of all facets of metabolic health, including weight circumference,” Limena says. “Because of this, products that showcase microbiome-supporting solutions — including prebiotics, probiotics and postbiotics — are trending and opening doors for beverage manufacturers to bring innovative products to market that target consumers’ weight management goals.”

Formulating health

As more consumers look to beverages as a convenient way to get the nutrients they need, experts highlight how various ingredients work in formulations to support weight management.

Thom King, chief food scientist and CEO of Icon Foods, Portland, Ore., highlights how crucial fiber is to supporting overall well-being.

“Fiber is an unsung hero for weight management — it aids in satiety and is metabolized into butyrate which impacts mitochondrial function to power your cells and give you energy,” he explains. “It’s also necessary for a healthy microbiome to support your immune system, as well as dopamine and serotonin production.

“Butyrate is a short chain fatty acid that is a major metabolite of the bacterial fermentation of indigestible carbohydrates commonly known as prebiotic fibers,” King continues. “It’s also reputed to have anti‐inflammatory properties and positive effects on body weight control and insulin sensitivity. This coincides and aligns with a lot of what our beverage customers and our formulations target.”

As an example, King points to functional sodas that contain no sugar, but incorporate prebiotic fibers to satiate, while serving as a source of fiber for butyrate.

Moreover, King points to the importance of specifically formulating beverages that support active lifestyles.

“People engaging in an active lifestyle need to restore hydration from fluid lost during their workout, as well as electrolytes, especially potassium, magnesium and sodium chloride,” he says. “As it is, a majority of the public has low magnesium. Potassium can help with muscle cramps.

“A perfect hydration system includes electrolytes and fiber, with no added sugar, because spiking blood sugar levels is a pathway to inflammation, gut issues, metabolic disease and more, as well as counterproductive to hydration,” King continues.

Echoing similar sentiments, ADM’s Limena stresses the importance of solutions that support metabolic health.

“A perfect hydration system includes electrolytes and fiber, with no added sugar, because spiking blood sugar levels is a pathway to inflammation, gut issues, metabolic disease and more, as well as counterproductive to hydration.”

— Thom King, chief food scientist and CEO of Icon Foods

“Our ongoing research into new microbial strains is supporting this crucial area, ultimately helping to bring tailored beverages to the forefront that support weight management,” she says. “For example, our award-winning BPL1 probiotic (Bifidobacterium animalis subsp. lactis CECT 8145) and its heat-treated postbiotic counterpart target factors relevant to metabolic health.

“Emerging evidence also suggests that BPL1 — in combination with diet and exercise — may help support weight management, a healthy body mass index (BMI) and metabolic health pathways,” she continues.

In addition to postbiotics like BPL1, Limena notes that prebiotic dietary fiber also remains in focus for weight management and digestive health support.

Pointing to ADM’s Fibersol, this prebiotic dietary fiber “is supported by over 30 years of research, with clinical studies indicating that it promotes the growth of gut microbes that are positively associated with health,” Limena says.

“Fibersol not only provides highly sought-after added fiber content, but it can also support reduced-sugar and low-calorie beverage applications, which are important components in the weight management space,” she explains.

Alongside fiber, Cargill’s Saunders points to proteins as central to formulations that support satiety and fullness.

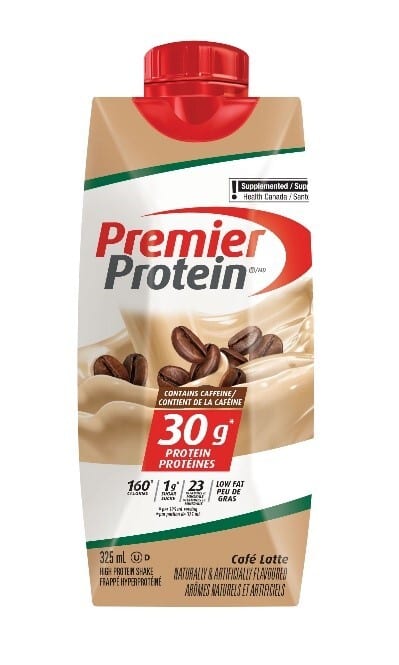

Containing 160 calories, 1 gram of sugar, and 23 vitamins and minerals, Premier Protein’s Café Latte shake is a healthy way to fuel you further, it says (Image courtesy of Premier Protein)

“Many consumers believe protein helps them feel full longer versus options higher in carbohydrates, an idea reinforced by trendy diets, which also emphasize protein consumption,” Saunders says. “In the trendy plant-based space, pea protein has become the go-to protein-fortifying ingredient.

“Nutritionally, it’s high in protein — Cargill’s option from PURIS is at least 80% protein — and it has a solid PDCAAS (protein digestibility corrected amino acid score) of 0.78, well above most plant proteins,” she continues. “Alongside those nutritional benefits, advances in technology have yielded pea protein SKUs developed specifically for beverages.”

In addition to proteins, Saunders notes that sugar reduction is another factor in many formulations, and also a focus for Cargill.

“For more than two decades, we’ve been helping brands reduce sugar and calories in a wide array of food and beverage applications — without sacrificing taste, the single biggest driver of purchase,” Saunders says. “Cargill’s newest sweetener system, EverSweet + ClearFlo, is a great example. It brings together our premier stevia sweetener with a natural flavor.”

Reworking the landscape

Although weight management drinks often are associated with low-calorie, low-sugar ingredients, experts highlight how sugar-reduction trends are impacting the industry.

Citing the International Food Information Council (IFIC) “2023 Food & Health Survey,” Cargill’s Saunders notes that consumers rank sugar reduction as the top way to make processed foods and beverages healthier. “At the same time, consumers continue to move away from artificial sweeteners,” Saunders says. “More than half of U.S. consumers (52%) say no artificial sweeteners is an ‘extremely’ or ‘very important’ statement on food and beverage labels.”

Further, as consumers remain wary of sugar, Saunders questions how much impact weight-loss aids, like Ozempic, will have on the weight-management landscape.

“Already, some brands are envisioning developing complementary food and beverage products that support weight loss and help people get the nutrition they need,” she explains.

Icon Foods’ King anticipates that sugar reduction trends will not only have a sweeping effect on beverages, but impact consumer packaged goods (CPG) in general.

“I think the whole CPG industry is about to be rocked. Companies that are manufacturing products that are ultra-processed, high in carbs and high in sugar are going to see double-digit declines in the next year,” King says. “Why? The rise of GLP-1 (glucagon-like peptide-1) agonists are set to change the weight loss and weight management industry, with a ripple effect to all CPGs.”

King explains that, while GLP-1 agonists are not pharmaceutical drugs but rather peptides that trigger the receptors in the brain to signal satiety, the result will have a profound impact on consumers’ food and beverage choices.

“[GLP-1] effectively rewires the brain to not have an appetite for high carb, high sugar foods,” he explains. “People may still crave a sweet flavor, but they won’t want a high level of sugar.

“Only 2% of the American public has chosen to use GLP-1 agonists, like Ozempic, to lose weight,” King continues. “Yet, Walmart’s CEO says it’s already seeing an impact on food-shopping demand from people taking Ozempic, Wegovy and other appetite-suppressing medications.”

Furthermore, King notes that those losing weight with the use of GLP-1 agonists will notice thirst, experiencing electrolyte depletion.

“This is where you will see massive upward movement of hydration systems that have zero added sugar, are clean label and contain plenty of electrolytes,” he explains. ”We are experiencing a spike in this category right now and 2024 will eclipse 2023.”

Moving forward into the future

Given global health trends, experts note that demand for products that support weight management seem destined to grow.

Yet, one big factor looming over the beverage segment is taste, Cargill’s Saunders says.

“Current products don’t always live up to consumers’ expectations, with two in five reporting ‘diet’ products don’t taste as good as ‘regular’ products,” she notes, citing Innova Market Insights’ 2023 “Health & Nutrition Survey.” “Fortunately, ingredient suppliers continue to bring advances to the marketplace, equipping beverage formulators with the tools to close those lingering gaps.”

ADM’s Limena highlights how functional beverage formats can target consumers’ individual needs going forward.

“Personalization for life stages and flexibility in flavor, format and function are key to capturing consumers’ attention in the weight management space, and beverages provide convenience and portability,” she says. “Plus, if a product is convenient and tasty, consumers are more likely to regularly consume them according to product directions, helping consumers see intended benefits.

“There is also great growth potential for health and wellness brands to combine various functional ingredients into one beverage offering, targeting multiple wellness attributes in a single offering,” Limena continues. “Think a RTD cookies n’ cream shake packed with protein, vitamins and minerals or a refreshing citrus sparkling water with biotics and prebiotic fiber.”

Moreover, Limena points back to gut microbiome-supporting solutions as presenting vast opportunities.

“For the beverage industry, postbiotics that are backed by science will change the scene dramatically, impacting manufacturing costs and processes in a positive way, with little or no impact on taste profiles, a critical aspect of successful RTD products,” she says.

In regards to drinks that support the mircobiome, Icon Food’s King echoes similar sentiments.

“Beverages that work with the body’s natural ability to control blood glucose levels, curtail metabolic disease and feed the microbiome have a fantastic future ahead,” he concludes. BI