Beverage

R&D

Change through color

By Lauren Sabetta

Natural colors help beverage-makers break from conventional

(Image courtesy of Getty Images)

Famous for his role in pioneering Cubism and for his melancholy Blue Period pieces, painter, sculptor and printmaker Pablo Picasso, is quoted for having said, “Colors, like features, follow the changes of the emotions.”

As color concepts often communicate various emotions through artistry or illustration, similarly, in the world of beverages, colors are used to connect and communicate with consumers.

“Color can be used to help brands connect with consumers on both a functional and an emotional level,” says Alice Lee, technical marketing manager at GNT USA, Dallas, N.C. “In a functional juice drink, color might be used to signal the active, healing ingredient of a fruit, vegetable or plant.

“For example, the orange pigment in carrots is the healthy carotenoid beta-carotene,” Lee continues. “A gamer drink, on the other hand, might feature a galactic purple hue to help create an out-of-this-world experience for the consumer.”

Kelly Newsome, senior global marketing manager for colors at Chicago-based ADM, points to adventurous colors as influencing consumers’ drink choices.

“A desire for excitement and exploration is influencing consumers’ beverage choices — from fizzy grape energy drinks to exotic lychee mocktails. This, in turn, is impacting the color trends we see breaking the conventional,” Newsome says. “Think rich purples, vibrant pinks and vivid reds.

“Consumers want bold and bright visual appeal that captivates their senses from the first look,” she continues. “Beverage brands that can create this experience while also leveraging natural sources will find success with conscientious consumers.”

ADVERTISEMENT

Fruit and vegetable concentrates are suitable for almost any beverage application, including CSDs, juice drinks, alcohol drinks and instant beverages, GNT’s Alice Lee notes. (Image courtesy of GNT USA)

Natural and organic wins the day

As wellness trends have taken hold in the beverage space, experts highlight how natural and organic trends are impacting color choices used in the market.

“Naturalness is now an expectation, not a bonus, for shoppers,” says Meghan Skidmore, content marketing lead at Sensient Food Colors, St. Louis. “Natural, organic, and plant-based color solutions support brands that are seeking to meet consumer demands for simple and recognizable ingredient lists.

“Consumers are conscious of their well-being as a holistic consideration, and ingredient-specific claims like ‘no artificial colors’ are highly motivating on beverages,” she continues.

Emina Goodman, senior director for colors at ADM, echoes similar sentiments, noting that consumers increasingly are examining product labels for ingredients they deem as “closer-to-nature.”

In fact, 75% of consumers across North America agree/strongly agree with the importance of food and drink products not containing artificial colors, Goodman says, citing FMCG Gurus’ 2023 “Flavors, Colors and Textures in North America” report.

GNT’s Lee notes that, where artificial ingredients can limit product acceptance, natural colors play a vital role in the success of beverage products, influencing shelf appeal, flavor expectations and product enjoyment.

“Modern consumers value and remain loyal to brands that communicate trust and transparency, which begins by offering products that boast clean labels,” she says. “Tapping into the limitless potential of the natural color toolbox enables developers to create vividly colored products with consumer-friendly label declarations."

Stephen J. Lauro, president of colorMaker Inc., Anaheim, Calif., notes that, as the industry moves away from artificial colors, natural colors can be used to strengthen clean label attributes in drinks.

“From our experience, natural colors may be used with great success in beverages when they are intended to supplement color contributed by fruit and/or vegetable juices,” he says. “Two issues often arise with fruit and vegetable juices. One, the color contributed by fruit and vegetable juices is weak; and two, color contributed by fruit and vegetable juices varies from harvest to harvest. Natural colors may be used to both strengthen and standardize fruit and/or vegetable juices.

“Further, if the beverage features several different vegetable juices, then a natural red color, for example, derived from purple carrots or purple sweet potatoes may be added and simply labeled as ‘vegetable juice (for color)’,” Lauro continues. “In this example, a color additive from vegetable juice sits alongside vegetable juices, making for a very clean label.”

Moving away from synthetic

Although synthetic colors are considered to be cost-effective and relatively straightforward to use in beverage applications, experts note that brands increasingly are opting to use natural and organic colors instead.

“Naturalness is now an expectation, not a bonus, for shoppers. Natural, organic, and plant-based color solutions support brands that are seeking to meet consumer demands for simple and recognizable ingredient lists.”

— Meghan Skidmore, content marketing lead at Sensient Food Colors

“Many brands have relied on synthetic colors for a long time and transitioning to natural colors can be a daunting prospect,” GNT’s Lee explains. “Plant-based colors can deliver shades with similar vibrancy to artificial colors in many applications, but it’s often very difficult to match the artificial color precisely.

“To make the switch, manufacturers must also grapple with concerns including selecting suitable raw materials based on desired color, cost considerations, and meeting performance targets,” she continues. “Additionally, they have to think about factors such as pH, base color, packaging and shelf life.”

Despite such challenges, Lee emphasizes that considering the pivotal role natural colors play in consumers’ purchasing decisions, the benefits far exceed the initial effort required.

“EXBERRY colors fit perfectly with these trends” she says. “They’re created from non-GMO fruits, vegetables, and plants using physical processing methods such as chopping and boiling, so they support cleaner label declarations such as ‘fruit and vegetable juice for color.’ They’re actually food concentrates that can be eaten by the spoonful and are suitable for almost any application, including CSDs, juice drinks, alcoholic drinks and instant beverages.”

ADM’s Goodman points to the company’s Color from Nature library, which delivers on naturally derived colors without impacting the sensory appeal of beverages.

“Our Colors from Nature library provides outstanding stability, helping manufacturers adapt to calls for visually stunning beverages made with colors derived from natural sources,” she explains. “Through our vertically integrated supply chain, we are involved in every step of the process when developing our color solutions, from growing to harvesting, washing, pigment extraction and filtration.

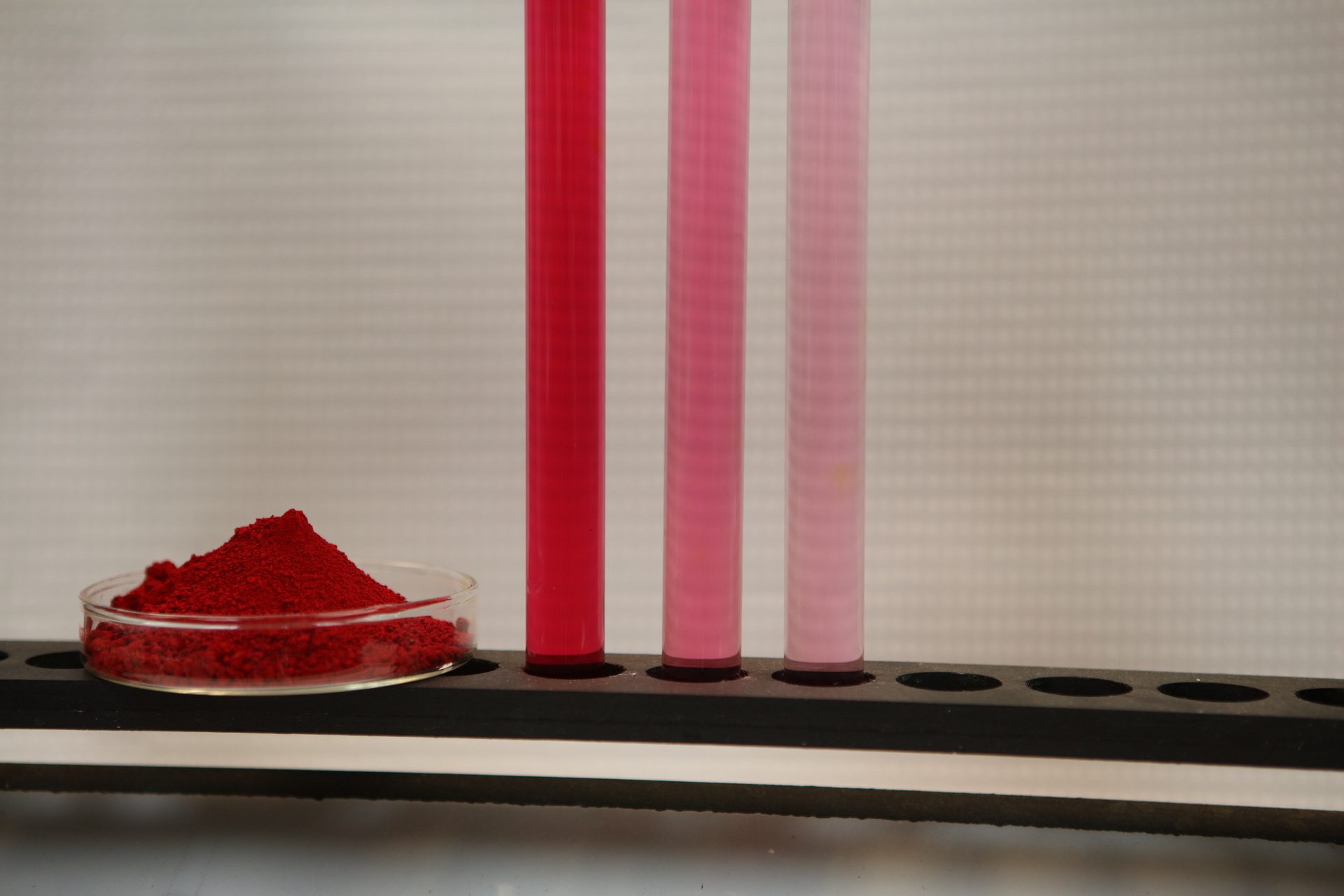

Red color solutions, made from a variety of natural sources, give brands clean label alternatives to synthetic colors like Red No. 3, experts note. (Image courtesy of colorMaker Inc.)

Further, Goodman points to the Color from Nature portfolio as providing an alternative to artificial colors like Red No. 3 at a time when clean label alternatives are high in demand.

“Our extensive Colors from Nature portfolio also includes red and pink color solutions made from a variety of natural sources, giving brands clean label alternatives to Red No. 40 and Red No. 3 while maintaining an exceptional sensory experience,” she says. “Specifically for beverages, our black carrot-derived color solutions deliver a number of different shades, such as reddish-pink, true red, deep red and concord red, for captivating ready-to-drink (RTD) cocktails, carbonated soft drinks (CSDs) and energy drinks.”

GNT’s Lee points to how natural and organic trends are impacting not only color ingredients, but brands’ choice of shades.

“It wasn’t always possible to create natural blue drinks, but the FDA now permits the use of spirulina extracts in beverages, which gives manufacturers a clean-label alternative to Blue 1,” Lee continues. “EXBERRY Blue for Beverages is a patented formulation solution that makes it possible to achieve vibrant blue shades with spirulina in applications including sports, energy, and carbonated drinks, juice drinks, enhanced waters, and alcoholic beverages below 20% ABV.”

ADM’s Goodman points to the company’s relationship with harvesters of the Amazonian huito fruit—securing an exclusive agreement for the supply of a unique blue pigment from nature.

“Leveraging our proprietary technology, we create our patented, market-leading fruit juice blue, which is acid-, light- and heat-stable, ensuring it retains its bold blue hue through various processing conditions. For beverages, this is particularly important, especially when it comes to pH instability,” Goodman says. “We recently expanded upon our blue color solutions to support improved color stability, producing a consistent, vivid blue across pH systems, including low to neutral pH levels. Not only does our fruit juice blue create a ‘true blue’ color, but it also helps build a range of purples, greens and browns.”

Regulatory impacts on colors

As demand for natural color ingredients trends upward, experts highlight some of the challenges facing manufacturers as the market transitions.

“Some of the biggest challenges currently are coming from regulatory changes,” Sensient’s Skidmore explains. “The European Commission banned titanium dioxide in food and beverages last year, and there is pressure in North America for brands to remove it as well. Although clean label whitening and opacifying agents aren’t currently required, as titanium dioxide is still permitted and has been safely used for decades, there is consumer pushback against this ingredient.

“Similarly, several U.S. states are considering legal action against FD&C Red 3, a synthetic color for bright pinks and reds across applications,” Skidmore continues. “A bill in California has passed and if signed into law would be the first time a state has banned ingredients permitted by the FDA, functionally preventing use of Red 3 in food and beverages in the U.S.”

colorMaker’s Lauro points to regulatory changes regarding organic and non-organic ingredients.

“We see a continued trend in beverages developed to be organic certified versus beverages that are ‘merely natural,’” he explains. “Specifically, the organic certified beverage market continues to separate from the natural beverage market.”

In line with this, Lauro highlights that in March 2024, turmeric will be removed from the list of non-organic certified agricultural products that may be used in organic products.

“Stated more succinctly, after March 2024 only organic certified turmeric may be used in organic certified beverage products,” he says. “We expect the price of organic certified turmeric to rise. This may be challenging for beverage formulators working on organic certified beverages.”

Looking toward a colorful future

As brands become more creative with the use of color to meet market demands, experts highlight some key trends to look out for in the near future.

“We see consumers placing greater emphasis on self-expression, with luxurious shades of fiery red, decadent apricot and sparkling grape, as well as an array of blues, making a splash in person and on social media,” ADM’s Newsome says.

Further, as affordability continues to be top of mind for many, Newsome points to consumers leaning further into economical versions of their favorite products and gravitating to reinventions of nostalgic options

“This reinvention especially ties into the demand for naturally derived shades,” she says. “Brands are tapping colors derived from natural sources to replicate playful and bright blues and yellows, powerful pinks and pistachio-like greens in beverages like RTD shakes and CSDs.”

Moreover, as consumer demand for functional beverages is not subsiding, Newsome notes that beverages positioned to support tailored wellness goals, such as energy, relaxation, hydration, and digestive and immune function support, are on the rise.

“Going forward, it will be crucial for colors that resonate with these focus areas to pop off the shelf,” she says.

colorMaker’s Lauro points to the company working on matching or “pairing” different beverage formats to each other.

“In our lab, we are working with several different customers who want to launch ‘matching’ powdered and ready-to-drink (RTD) beverages,” he explains. “In other words, they want a powdered beverage, when dissolved in water, to look just like the RTD version of the same beverage.

“In addition, some of these beverages are fortified with the latest and greatest herbs ― from ashwagandha to mushrooms ― which add opacity (visually) and specific pH requirements (chemically),” he continues. “As you might imagine, this can be a very challenging project. Matching or ‘paired’ beverages may be on the horizon for the beverage industry.”

GNT’s Lee points to brands thinking about how ingredients work alongside packaging and branding.

“Whether they use bold and bright shades or wholesome tones inspired by nature, color plays a huge role in helping to build a brand or product identity that will resonate,” Lee says. “We expect to see more brands taking risks, standing out from the crowd, and using unexpected color choices to unite their product ranges.” BI