Category Focus

Evolving tastes

Dairy alternative market shifts gears to meet current challenges

By Lauren Sabetta

(Image courtesy of Benexia)

Best known as the lead vocalist of the band Blondie, with four of her songs reaching No. 1 on the U.S. charts between 1979 and 1981, Debbie Harry is quoted for saying, “It’s amazing to me to see how bands evolve and how they take all their influences and come up with their own sound.”

When it comes to the dairy alternative beverage market, similarly, experts note that although the market has slowed, brands within this space are evolving — influenced by consumer demand for broader functional benefits.

“The dairy alternative space has hit a reset,” says Mitch Madoff, head of retail partnerships for Keychain, New York. “Growth has slowed a bit for the big players like almond and oat milk, but the category isn’t stalling — it’s evolving.

“Shoppers once grabbed any non-dairy drink on the shelf but now they’re more intentional and looking for drinks that deliver something extra, whether that’s protein, functional benefits, or a more sustainable profile,” Madoff continues. “That’s why we’re seeing momentum in hemp and protein-based beverages like Living Harvest’s Original Hempmilk, as well as newer blends that incorporate ingredients like flax, pea or even sesame. It shows that consumers are still open to trying new things but are just more selective about where they choose to spend their money.”

Jack Doggett, food and drink consumer insights analyst at Mintel, Chicago, explains that the momentum in the dairy alternative market has slowed, beginning in the 2020s.

“Sales fell for the first time in 2024 (-3.1%) and are estimated to slip another 2.6% in 2025. Almond milk is the largest segment and has struggled the most, seeing an estimated decrease of 7.2% in 2025 sales,” Doggett says. “However, other major plant-based milks have experienced increases in 2025, namely coconut (plus 2.8%), soy (plus 4%), and oat (plus 0.4%). The shift toward alternatives like coconut and soy has been primarily driven by young consumers motivated by variety in both nutrition and flavor.”

John Rodwan, editorial director of Beverage Marketing Corporation (BMC), Wintersville, Ohio, echoes similar sentiments when it comes to volume.

“The U.S. dairy alternative/plant milk market has been struggling recently, with three consecutive years of volume shrinkage through 2024 and additional losses likely this year and for the next several years,” he says.

Oatly recently unveiled a limited-edition Hot Cocoa Oatmilk, designed to be served warm. The dairy-free take on this holiday classic is certified gluten-free, glyphosate-residue-free, and non-GMO, plus it contains vitamins A, D, B12, and beta-glucans, the company says.

(Image courtesy of Oatly)

Rodwan adds that despite these losses, some consumer trends responsible for driving growth still have market influence.

“Some of the same trends that drove growth years ago when ‘plant milk’ was virtually synonymous with ‘soy milk,’ such as specific dietary needs (such as lactose intolerance) or preferences (such as veganism), still shape the market,” he explains. “However, one of the market’s enduring challenges — finding formulations consumers actually enjoy drinking — has fueled decisive shifts within the plant milk category, with an exodus away from soy toward other plant milk types.”

Mintel’s Doggett notes that nutrition is top-of-mind for plant milk consumers in 2025.

“Rather than being selected solely for being plant-based, dairy alternatives now stand out by offering nutritional benefits and unique flavors,” he says. “The excitement surrounding protein has emerged in non-dairy milks as well — it is undoubtedly the top benefit consumers are willing to pay more for.

“Consumers are also keeping a close eye on ingredient lists, preferring simple formulations to avoid overprocessing,” Doggett continues. “Broader trends in the food and drink industry, such as clean formulations supporting muscle building and overall wellness, are encouraging non-dairy milk consumption.”

Keychain’s Madoff also notes how broader consumer trends are impacting today’s dairy alternative space.

“People aren’t just reaching for plant milk because it’s ‘not dairy’ anymore,” he says. “They expect it to add something to their lifestyle. That could mean extra protein, a cleaner label, or a sustainability story that feels real. Younger shoppers especially want beverages that fit into their routines, whether that’s fueling their kids, supporting their overall health, or lowering their impact on the planet.”

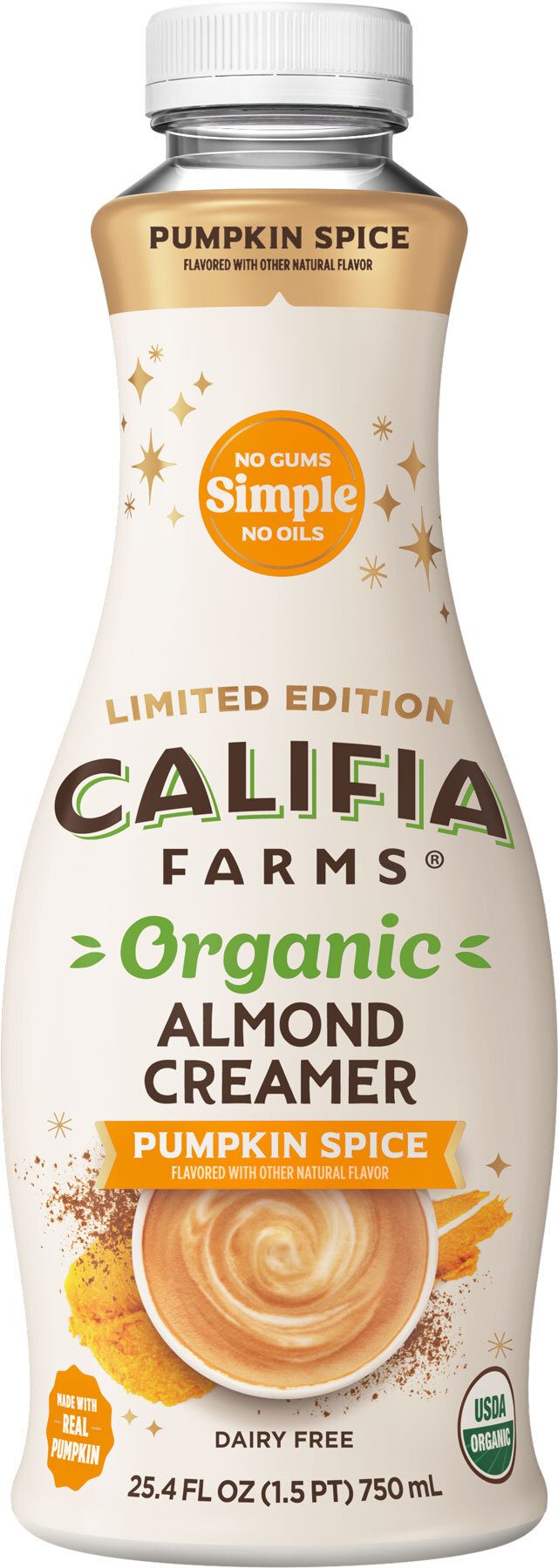

Califia Farms introduced its dairy-free Organic Pumpkin Spice Almond Creamer, made with no gums or oils and with simple ingredients like real pumpkin puree, organic almond milk and warm spices, the company notes.

(Image courtesy of Califia Farms)

Market shifts lead to challenges, innovation

Given the recent market shift, experts highlight which dairy alternative segments are playing into current trends and what attributes these segments have to offer.

Mintel’s Doggett notes that soy milk’s high natural protein content has benefited from the focus on protein, with brands releasing options with additional protein and simple formulations.

“Nut milks, such as pistachio, also promote inherent protein benefits to expand their appeal,” he says. “Coconut milk is leaning into flavor, using its versatile base as a natural pairing with fruits and other sweet options. Across all segments, brands are addressing concerns about overprocessing by releasing formulations with minimal ingredients — often no more than five — while maintaining protein as a main benefit.”

BMC’s Rodwan explains that among categories, almond milk became the biggest plant milk segment several years ago and now accounts for almost two-thirds of category volume.

“Oat milk became the No. 2 segment a few years ago. And coconut milk is moving up in the rankings,” he says. “All three boast flavor, mouthfeel and nutritional benefits many consumers perceive as superior to staid soy milk.”

Keychain’s Madoff, meanwhile, notes that althoughalmond and oat milk used to be the default go-to, there’s been a market shift with hemp and other seed-based milks emerging as serious contenders.

“They tick a lot of boxes consumers are looking for: fewer allergens, cleaner labels, and a sustainability aspect that resonates,” he explains. “At the same time, we’re seeing standouts in the almond space on Keychain’s platform. Brands like MALK, with its organic almond milk, are growing because they deliver the level of transparency today’s shoppers are looking for. From our point of view, the winning segments are the ones that feel purposeful and authentic.”

As far as challenges affecting nut, seed and plant milks, Madoff says that thealternative milk aisle is crowded, plus consumers are more price-sensitive than ever.

“On top of that, they’re asking tougher questions: how processed is this, and is it really worth the cost? At Keychain, we’re seeing brands respond by tightening up ingredient lists, leaning into functional benefits, and telling a clearer story about what makes them different,” Madoff explains. “Limited-edition products and seasonal launches are also becoming more common as a way to keep shelves fresh without overcommitting, while added benefits like protein boosts help products stand out.”

BMC’s Rodwan says the market challenge is that segments periodically emerge and enjoy episodes of strong growth; however, such segments tend to cannibalize other segments rather than drive overall category growth.

“Thus, volume growth in almond and oat milk coincided with volume contraction for soy milk,” Rodwan explains. “A sort of churning in the category occurs, with consumers shifting from one type to another, rather than new types or flavors attracting new consumers to the category.

“Companies and their brands continue to do what they have traditionally done: devise new flavors/types that they hope will resonate with consumers,” he continues. “Lately, coconut milk has been the standout type, with a couple years of double-digit volume growth rates in 2023 and 2024 (even as other types decline).”

Mintel’s Doggett considers the perceptions of dairy alternatives as being overprocessed and unnatural to be a persistent challenge.

“Consumers agree that minimally processed milk with few ingredients is healthier, part of the reason why non-dairy milk sales have softened recently,” he says. “Some consumers, particularly non-dairy drinkers, also report that non-dairy milk doesn’t have enough nutrients for them. A higher overall price point for alternative dairy also hinders growth, and even with higher prices, consumers don’t believe that non-dairy milk is more premium than dairy milk.

“Brands have been focused on releasing simple formulations to combat worries about overprocessing,” Doggett continues. “Additionally, brands like Silk have marketed their products as athletic companions to convince consumers that the nutrients they provide are enough to energize them. Rather than positioning themselves as dairy alternatives, most brands are focusing on what their specific product can offer, accepting that many consumers drink both dairy and non-dairy milk.”

“Shoppers once grabbed any non-dairy drink on the shelf but now they’re more intentional and looking for drinks that deliver something extra, whether that’s protein, functional benefits, or a more sustainable profile.”

– Mitch Madoff, head of retail partnerships for Keychain

Future factors to consider

Beyond consumer trends, sustainability is having an impact on the nut, seed and plant milks market, experts note.

“Sustainability questions certainly were a major concern for some consumers a few years ago, especially with ‘thirsty’ almonds,” BMC’s Rodwan says. “Compared with dairy milk, however, plant milk continues to have something of a beneficial aura.”

Mintel’s Doggett notes that consumers often associate simplicity with sustainability, boosting the popularity of simple formulations in this market.

“While over half of non-dairy drinkers consider the environment while buying milk, the reality is that overt sustainability is no longer a top factor for alternative dairy milk choice” he explains. Nutrients, taste, naturality, and simplicity all outrank sustainability, even among young consumers.

“Brands have also shifted away from marketing their products as sustainable. To consumers, it is more of a secondary benefit than a selling point,” Doggett continues. “However, as climate change impacts the availability and production processes of nut, seed and plant-based milks, sustainability may re-enter the spotlight as consumers begin to feel its effects on the food and drink industry.”

Keychain’s Madoff says that sustainability has become a deciding factor in consumer preferences.

“The amount of water required for almond growth is hard for some consumers to get past, and oat milk, which had its big moment, is now facing some criticism too,” he explains. “Meanwhile, hemp and pea milks are seen as more eco-friendly, and that’s helping them win with climate-conscious shoppers. The brands that connect with consumers by showing they use fewer resources or support better farming practices are the ones with real staying power.”

Looking ahead, Madoff anticipates that the market is moving into a second phase of plant-based milks.

“The big names aren’t going away, but the growth is shifting toward brands that can deliver function, sustainability, and a story that feels fresh,” he says. “Keychain’s platform points to Ripple’s kids’ plant-based milk as a good example. It’s more than just a ‘dairy-free’ beverage — it’s positioned as a better-for-you drink with clear benefits. That’s where the category is going; it’s less about being an alternative and more about being the better, standout choice.”

BMC’s Rodwan, meanwhile, says that additional volume declines look likely for the plant milk market.

“Among the major segments, only oat and coconut milks appear poised for growth (though oat is projected to grow rather slowly),” he explains. “Almond, soy, rice, flax and hemp remain on track for decreases in the near future, Beverage Marketing projects.”

Mintel’s Doggett expects flavor and nutrition to be major focuses for both brands and consumers going forward.

“Consumers are reacting well to flavor-forward innovations in the plant-based market, so expect dairy alternative brands to build on this momentum and push forward sweet and unique flavor options,” he says. “Additionally, nutrition will continue to be a focal point, especially as prices rise and personal budgets get tighter due to economic pressures.

“Consumers will look to nutrient- dense products to meet their health goals, paving the way for non-dairy brands to ensure they are delivering on in-demand benefits like protein,” Doggett concludes.