Category Focus

Adventures in coffee consumption

By Jessica Jacobsen

Diverse consumer demands keep coffee market fresh

(Image courtesy of Táche )

The popular video game Mario Kart Deluxe 8 excited fans with the release of its Booster Course Pass, which allows gamers access to 48 additional courses and eight additional characters. With so many options, gamers can curate a racing experience suited to their skill level and entertainment. Although 96 courses might sound like a lot, it’s nothing compared with the options that consumers have today when selecting how they want their coffee.

“In this fourth wave of coffee, coffee is wearing many different hats,” says Kelsey Olsen, food and drink analyst at Mintel, Chicago. “Coffee has morphed into a beverage that can deliver both fun and function, capturing the 30% of consumers who are enthusiasts and providing energy to the 42% of coffee consumers who turn to the beverage as their go-to energy source. Meeting demands for both ― separately or simultaneously ― is an ongoing opportunity for brands to address a variety of needs.”

Mitch Madoff, head of retail partnerships at Keychain, New York, explains that consumers’ interest in personalized coffees is shaping the category.

“The greatest consumer trends really lean toward that customization and the different forms in which coffee comes in … nitro is really a big differentiator right now,” he explains. “It creates sort of the creamy sort of coffee drink with that foam and extra sweetness.

“The other forms really allow customers really to find what really suits their own preference so it’s sort of a pick your own adventure in the coffee industry right now — because of that customization specialization — the consumer is able to find what fits their daily habits and find products that they really enjoy to have on a daily basis,” Madoff continues. “That’s really what coffee is all about— is that daily routine.”

Meanwhile, Mintel’s Olsen notes that younger consumers are changing the way that coffee is approached.

NESCAFÉ introduced NESCAFÉ Gold Espresso and NESCAFÉ Ice Roast to its U.S. portfolio. (Image courtesy of Nestlé)

“[W]ith the growing variety of options and the corresponding variety in occasions, younger generations, particularly, may be rewriting the traditional coffee ‘as part of the morning routine’ story, and coffee may be turning more into a beverage that is part of rituals and different moments rather than the same routine each morning,” she explains. “For instance – Baby Boomers (51%) were twice as likely as Gen Z (24%) to associate hot brewed coffee with being part of their morning routine.

“There is an emerging topic coming into play regarding caffeine and mental health driven by Gen Z: 25% of Gen Z coffee consumers are worried about caffeine’s impact on their mental health,” Olsen continues. “This is bringing rise to innovation centered [on] mental wellness and balanced caffeine experiences (like mushroom coffee), but also opening up paths to modernize decaf and half-caf coffee for modern needs.”

Layered approach

As the coffee category evolves to meet with the interests of consumers, experts highlight the impact that various attributes are having, including premiumization, fortification and caffeine levels.

Building on customization trends, Keychain’s Madoff notes that the premium and super-premium innovations are helping lift the coffee category.

“I think the premium and super-premium is really what’s driving consumer interest and preference in the category right now,” he says. “It really helps shape the customers’ preference and expectations in what they’re drinking every day.”

He explains that sourcing is among the attributes that consumers look at, including Fair Trade Certified or Rainforest Alliance Certified. The sourcing practices at origin also is influencing the flavor profiles that consumers are interested in.

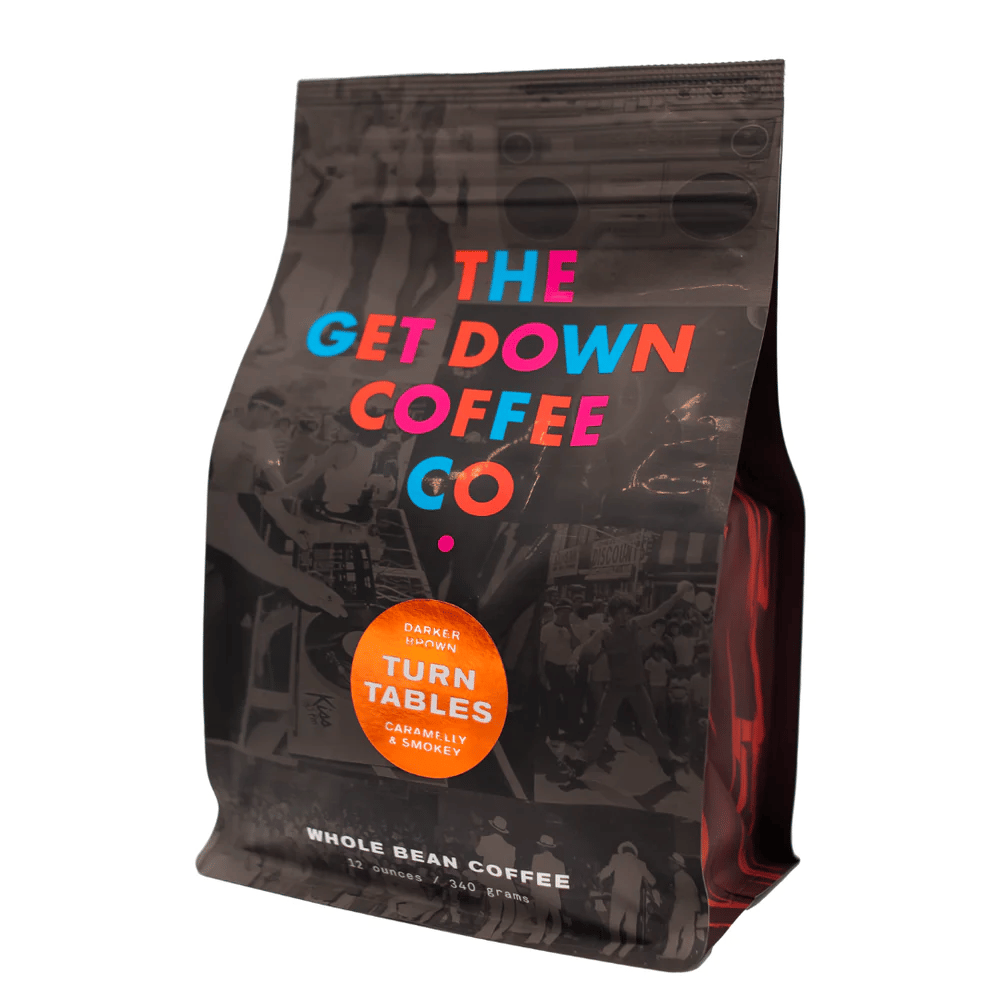

“I think the consumers moving from a more lightly roasted to a somewhat darker roasted coffee really brings out the flavors more than how it’s marketed at shelf, [and] those claims and attributes you can make about the coffee,” Madoff says. “What are stories about the origin even stories it sometimes gets to the micro-farm the coffee’s grown at. I think this premium and super-premium trend is something you’ll continue to see as the coffee consumer gets more sophisticated in the coffees that they’re drinking.”

Roger Dilworth, senior analyst at Beverage Marketing Corporation (BMC), Wintersville, Ohio, also highlights that impact premiumization is having on coffee.

“There continues to be evidence that some consumers are opting for coffee with perceived better qualities and thus premium and super-premium trends are having a somewhat positive effect,” he says.

Mintel’s Olsen notes that consumers have expressed affinity for premium coffee, however, she notes that the definition of what is premium is unique to the individual consumer.

*Includes brands not listed.

Source: Circana, Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending July 14.

Top single-cup coffee (Individual brands)

*Includes brands not listed.

Source: Circana, Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending July 14.

Top refrigerated ready-to-drink coffee

“Almost one in three coffee consumers agree that premium coffee is an affordable luxury, yet 30% agree that store-brand coffee is just as good as name brands,” Olsen says. “Premium coffee is likely more personal and defined by different coffee consumers.

“Its definition is also likely evolving as we move through the fourth wave of coffee,” she continues. “For instance ― in this fourth wave, where consumers are crafting their own coffee drinks ― instant coffee has risen in popularity as an option that allows accessible and quick routes to customized coffee, and defies the notion that coffee enthusiasts need all of the fancy coffee preparation equipment.”

Perhaps considered a sub-segment within the premiumization umbrella has been the emergence of better-for-you (BFY) coffee drinks.

“Another example that’s sort of new, it’s been the last few years, but it’s also helping to fuel some of that growth is coffee that’s fortified whether it’s vitamins or it could be different mushrooms they’re adding into the coffee right now so that allows brands to differentiate them on shelf,” Keychain’s Madoff says. “It has a competitive advantage by how they’re positioned on the shelf compared to different coffees that might be out there and it allows them to target very specific groups that might be more health conscious or potentially older adults that are in need of a special diet.”

Madoff further highlights that the fortification of coffee allows brands to differentiate themselves on shelves.

“I think this is targeting specific groups that are more health conscious and they’re looking for functional foods and functional beverages as opposed to what they’re used to like a daily coffee drink, so I think it’s having a significant impact on a totally new segment of customer and drawing them into the category,” he says.

Despite the opportunities to create a more targeted coffee brand, Mintel’s Olsen notes that fortification still is in early stages, but brands exploring different caffeine levels is opening more opportunities for the category.

“BFY coffee fortification remains a relatively niche space,” she says. “However, we are seeing innovation related to mindful caffeine consumption, likely driven by Gen Z’s concerns about caffeine and mental health.

“Some brands are innovating around caffeine levels specifically, whether that’s modernizing the decaf or half-caf space, or building a brand around a range of caffeine levels, like the Explorer Cold Brew brand that empowers consumers to choose their own adventure with four different caffeine level RTDs,” Olsen continues. “Some brands are fortifying with functional ingredients like adaptogens to double down on focus or bring a balance to the caffeine.”

Settling volatility

All the creative innovations flooding the coffee category come as it has navigated some performance challenges.

“The market has generally been fairly tepid,” BMC’s Dilworth says of the coffee market. “The inflationary environment in 2022 and 2023 led to solid declines in volume and robust retail dollar growth. In 2024, moderating inflation has led to a volume improvement and a deceleration in retail dollar sales growth.”

Mintel’s Olsen explains that despite some volatile years, dollar sales are expected to settle. Yet, volatility in other areas still is a concern.

“Future volatility is expected to emerge via supply chain issues tied largely to climate change, with the exact timeline still in question regarding when consumers will more directly feel the impacts,” she says. “Categories like chocolate, which are facing climate concerns have already seen skyrocketing prices, and leading chocolate brands are taking action and prioritizing sustainability.

“The coffee market may follow suit and see larger players prioritizing these initiatives, and not necessarily driven by consumer demand ― as only 19% of coffee consumers report that they are worried about climate change’s impact on coffee production,” Olsen continues. “In the shorter term, though, as inflation is expected to cool, the market’s growth is expected to return to more organic dollar sales growth as opposed to inflation-driven growth.”

Among the various coffee segments, Olsen notes that many have seen growth slow, except for instant coffee.

“Instant coffee may be benefiting from improved perceptions attributed to social media exposure (possibly even spurred by Dalgona coffee’s moment in the early pandemic days), followed by innovation and modernization of the category from a range of brands like Maxwell House’s Iced Latte Foam Instant Coffee line to Blue Bottle’s Craft Instant Espresso,” she says. “The underlying amplified convenience and accessibility (no coffee-making equipment required) is certainly pairing well with the modernization and exposure, too.”

“I think the premium and super-premium is really what’s driving consumer interest and preference in the category right now. It really helps shape the customers’ preference and expectations in what they’re drinking every day.”

— Mitch Madoff, head of retail partnerships at Keychain

Keychain’s Madoff highlights that its data is showing that coffee concentrates are posting strong growth numbers as well.

“From the data that we’re actually collecting on Keychain we can see that the market is continuing to grow steadily year after year and it’s really being driven by the coffee concentrate category, which is showing growth of over 60% year over year,” he says. “Some of the trends that we’re seeing have been in place for years, really continue to drive the market.

“It’s really around that customization of drinks or specialty as well as the different form factors in which you can deliver coffee these days. Whether it’s a nitro brew, a cold brew, ready-to-drink obviously for convenience purposes is really taking off, and even fortified coffees so the coffee category in general is still very healthy,” he continues.

BMC’s Dilworth notes that the contributions to the coffee category’s performance can be found across a variety of segments.

“From a retail dollar perspective, the biggest contributors to growth have been roast/ground, pods and RTD coffee,” he says. “Roast/ground marketers have been able to take price, with some premiumization. RTD coffee has been driven by cold brew, particularly Danone’s STōK brand. And even though pods have slowed from their rapid growth years of yore, they still have contributed meaningful incremental dollars in the past five years.”

For the next five years, Dilworth notes that volume will start to trend upward, but dollar sales are expected to decelerate.

“Volume for the overall coffee market is expected to increase at a 0.7% compound annual growth rate (CAGR) between 2024 and 2029, an improvement on the 2019-to-2024 period, when volume declined,” he says. “On the other hand, retail dollar growth is projected to decelerate to a 1.6% CAGR in the next five years. Cold brew will continue to have strong growth but it won’t be enough for RTD coffee as a whole, which is expected to grow at only a 1% CAGR between 2024 and 2029, with volume being flat.”

As the category navigates these hurdles, brands will continue to embrace the trends that have dominated new product development as well as engage with coming-of-age consumers, experts note.

“I think what you’re going to see is a doubling down on these current trends,” Madoff says. “Using the data that we collect on Keychain, that’s what we’re seeing. We’re seeing the retailers and brands really doubling down in this category and continuing to push different categories of coffee that are expanding so it’s the ready-to-drink category, cold brew, again this fortification of coffees that we discussed as well as the specialty drinks.

“You’re going to see that category of drinks continue to grow into the future, so I think it’s just a doubling down of what we’ve already seen in the category and that’s what we’re seeing in the data that we’re collecting,” he continues.

Mintel’s Olsen explains that the mean age of entry into the coffee category has declined with each generation.

“For instance, the mean age that baby boomers and Gen X entered the category was 19, 17 for millennials and 15 for Gen Z,” she says. “Now – with a new generation, Gen Alpha, entering their teens in the coming years, the older cohorts of this generation are likely to enter the coffee category in the near future. It’s likely that most of these consumers will enter the category by way of cold coffee.”

However, cold is not the only player for coffee going forward.

“Mintel consumer data does showcase that it’s not all about cold coffee, though, pointing to an opportunity for traditional hot coffees, as 29% of coffee consumers reported drinking more hot coffee this year compared to last year,” Olsen says.

“With so much attention on the growth of RTD coffee, innovation and competition in the category have followed,” she continues. “This is raising the bar for RTDs to deliver quality coffee experiences, especially for the one in three Gen Z and millennial coffee consumers who consider themselves coffee enthusiasts. RTD innovation ranges from incorporating different kinds of milk, like Pistachio milk or A2 dairy milk, to globally inspired RTDs made with different coffee bean varieties.” BI