SPECIAL REPORT

new product development

A preference for premiumization

Premiumization trends span across beverage industry

By Chloe Alverson

(Image courtesy of Olé Cocktail Co.)

Although consumer trends are ever changing, one trend that has stuck out is that of premiumization within the beverage industry.

Roger Dilworth, senior analyst at Beverage Marketing Corporation (BMC), Wintersville, Ohio, notes the consumer trends driving interest in premium and super-premium products in the beverage market.

“Consumer interest in premium and super-premium products seems to fall into two camps: life-extending and life-affirming,” he says. “Life-extending refers mostly to functional non-alcohol products that are purported to promoted good health, such as probiotics and nootropics. But it’s not all about extending life; it’s also about improving the quality of life in terms of cognition, weight management and sleep regulation, among others.”

Life-affirming refers to the psychological lift consumers get from consuming prestige products, which tends to occur more in the beverage alcohol space, Dilworth explains.

Mitch Madoff, head of retail partnerships at New York-based Keychain, says that more people are redefining what “premium” means in today’s market. It’s not about indulgence for its own sake anymore, he adds.

“Instead, they’re looking for beverages that align with their health goals, ethics or identity,” he states. “That might mean cleaner ingredients, added functional benefits or sustainable sourcing. They’ll pay more, but only if it feels worth it.”

Kaleigh Theriault, beverage alcohol thought leadership for NielsenIQ (NIQ), Chicago, expresses that the idea of premiumization is no longer about price alone, but perceived value.

“Consumers premiumize in beverage alcohol by purchasing premium, super premium, ultra-premium and luxury products,” she explains. “They also find premium experiences in bars and restaurants, cocktails, the purchasing of a higher quality product in a smaller size, rare or aged finishes on spirits, imported or unique origins, ready-to-drink (RTD) products and non-alcohol beer, wine and spirits.”

Consumers continue to gravitate toward high quality, trusted alcohol brands and are willing to pay more for quality, authenticity and experience, Theriault adds.

“Non-alcoholic products are an alternative to alcohol consumption and are growing,” she shares. “Dry January and the broader moderation movement drove this shift into what is now considered a consumer lifestyle choice. Potential changes in dietary guidelines and labeling, as well as general trend toward health and wellness, are also driving interest in this category.”

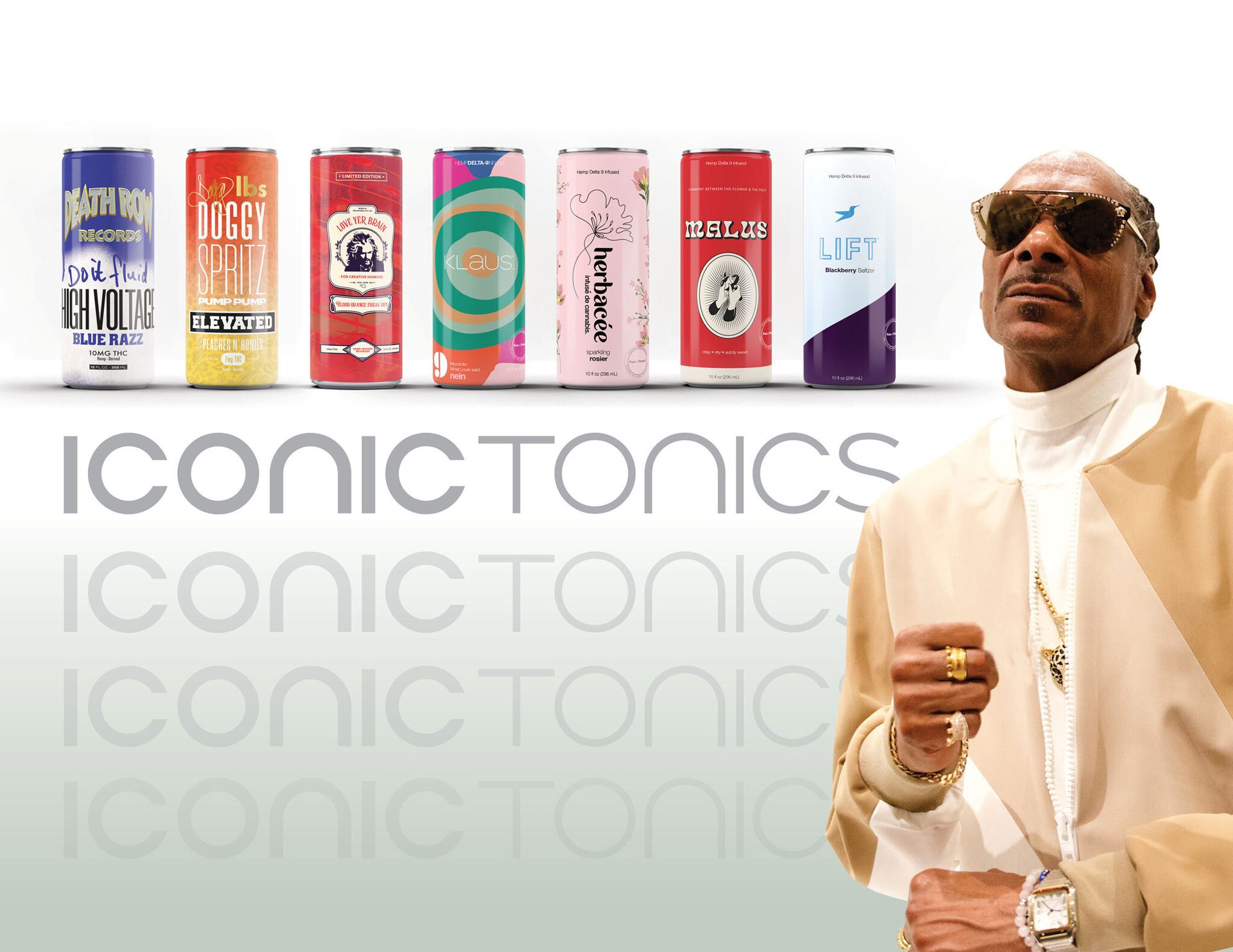

Earlier this year, Snoop Dogg partnered with and invested in Harmony Craft Beverage to launch Iconic Tonics, a premium functional beverage brand.

(Image courtesy of Iconic Tonics)

Enduring inflation

Despite premiumization’s influence on the beverage market, inflation has affected the performance of these premium beverages.

“There is a negative effect on volume due to inflation to all beverages, including premium beverages,” BMC’s Dilworth says. “But sometimes, there is paradox where some premium beverages can hold the line on prices and even lower them, thus making them seem less expensive compared to lower-priced brands that are forced to take price increases.”

Prior to the episode of high inflation in the 2022-2023 period, Dilworth notes there seems to have been a bifurcation effect within the beverage market, where higher-end and lower-end segments are performing satisfactorily, with the middle tier “getting squeezed.”

Keychain’s Madoff states that inflation might have made consumers more conscious about their spending, but it hasn’t stopped them from spending on premium beverages and products.

“People are still spending, but they expect real benefits,” he shares. “OLIPOP’s a great example. They lead with gut health functionality, and we’re seeing 30-90% growth among manufacturers on Keychain. Some flavors, like Cherry Cola, are spiking even higher — up to 330%.”

NIQ’s Theriault says that significant price increases for beer, combined with consumers’ sensitivity to price changes, have contributed to volume pressures across all alcohol segments in 2024.

“Economic pressures will continue to be a significant challenge for the beverage alcohol industry in 2025,” she notes.

The overall cost of living continues to rise, Theriault adds, prompting shifts in how consumers allocate their budgets.

“Still, in the beverage alcohol category, premiumization is steady, especially among super premium-plus spirits, super-premium beer, imports and wines priced around $20,” she explains. “Premiumization trends persist among higher-income consumers, highlighting the importance of catering to diverse needs. For beverage alcohol brands, this means striking a balance between value-oriented offerings and premium products.”

Strategic pricing, effective promotions and clear communication of a product’s value proposition are essential for retaining customer loyalty in a competitive landscape, Theriault explains.

“Brands that can address these dual demands — providing affordable options while emphasizing quality and innovation — will be better equipped to navigate economic headwinds and sustain growth in a challenging market,” she says.

Seeing success

Experts share which beverage categories are seeing the most activity in premium proliferation.

“In non-alcohol beverages, premiumization is usually tied to life-extension (or improvement) in the form of added functionality,” BMC’s Dilworth says. “With energy drinks, it is the ‘functional energy’ segment that emerged last decade, in which brands went beyond taurine and B vitamins to add ingredients more often found in sports nutrition products.”

Dilworth notes that these beverages do not necessarily have a higher price point, given that energy drinks already extracted a high premium.

“Some of the newer sports drink brands, some of which do sport a higher price, promise additional benefits, mostly relating to a higher amount of electrolytes,” he says. “Some such as the leading powdered electrolyte even tout a higher efficacy in getting hydration into the body’s cells.”

Functionality is necessarily more limited in beverage alcohol, Dilworth adds, as witnessed by the backlash over caffeinated malt-based brands a generation or two ago.

“Premium and super-premium is more geared toward life-affirming attributes such as badge value,” he explains. “Celebrity-backed and other higher-priced alcoholic beverages are designed to meet this consumer need. There is some badge value in non-alcohol beverages such as imported water, but this appears to have waned in importance over the past couple of decades.”

Snoop Dogg announced an investment and partnership with Harmony Craft Beverages to launch Iconic Tonics. The brand offers premium functional beverages “aimed at reshaping the category and redefining adult beverage alternatives,” the company says.

“I’ve always been about innovation, and functional beverages are the next frontier,” Snoop Dogg said in a statement. “People want drinks that do more than just taste good — they want benefits, and they want choices. Harmony Craft Beverages has been pioneering this movement, and together now as Iconic Tonics, we're bringing something fresh to the table. This is more than a brand — it’s a lifestyle.”

Functional beverages are at the forefront of this premiumization shift, Keychain’s Madoff expresses.

“Think gut health, clean energy or drinks with adaptogens and nootropics,” he says. “These products go beyond simple hydration or refreshment and deliver added value through science-backed wellness benefits. One example we’re tracking is Juni Tropical, a sparkling tea with adaptogens, and it’s seeing over 420% growth on Keychain.

“Brands that incorporate clean, purposeful ingredients and provide real health functionality are standing out in the market among consumers,” Madoff continues.

Meanwhile, NIQ’s Theriault notes that spirits continue to excel in premium moments with consumers, especially within tequila. In 2025, she shares that the health and wellness movement will continue to redefine the beverage alcohol landscape as consumers prioritize healthier lifestyles and mindful consumption.

“This shift is evident in the growing demand for low- and no-alcohol beverages, which offer the social experience of traditional drinks without compromising health goals,” Theriault says. “Beverages that leverage ‘better-for-you’ product attributes are also experiencing strong growth.”

For example, she shares that products that stated they were “free form artificial colors” saw a dollar sales growth of 74% over the last year. Products labeled as “eco-friendly certified” were up 28%, Theriault adds.

“Brands that invest in expanding their product lines to include these options can tap into a growing audience seeking a balance between enjoyment and health-conscious choices,” she says. “By leveraging these trends, companies can create products that resonate with evolving lifestyles while differentiating themselves in the market.”

“Consumers tend to fall back on bottled waters for their perceived safety and better taste compared to tap water. Safety, health and convenience perks will drive continued growth of bottled waters.”

– Julia Mills, food and drink analyst at Mintel

“Brands that can address these dual demands — providing affordable options while emphasizing quality and innovation — will be better equipped to navigate economic headwinds and sustain growth in a challenging market.”

– Kaleigh Theriault, beverage alcohol thought leadership for NielsenIQ

Common attributes

Premium and super-premium beverages share common attributes, from ingredients to packaging.

BMC’s Dilworth says that these attributes vary by segment.

“For some, it’s organic certification; for others, it’s inclusion of higher amounts of functional ingredients,” he notes. “Proprietary packaging, including premium glass packaging, continues to be an important element. Some brands even aspire to premium status by trumpeting their sustainability bona fides, such as employing packaging other than plastic, a packaging material that of course is coming under increasing fire lately.”

Premium beverages tend to emphasize clean, simple and often organic or non-GMO ingredients, Keychain’s Madoff shares.

“Functional ingredients like adaptogens, probiotics or clean protein are also becoming more and more common,” he says. “Premium brands also tend to lean into sleek, minimalist designs that signal trust and quality. This shift helps brands appear modern and refined, rather than too indulgent or extravagant.”

NIQ’s Theriault says flavor innovation remains a growth driver for the beverage alcohol market, particularly within the RTD segment.

“With strong growth of 4% to 5% year-over-year (YoY) for the past four years, RTD now accounts for a 12% share of total alcohol dollar sales,” she explains. “Convenience, versatility and innovation are driving factors behind this trend, as consumers increasingly gravitate toward pre-mixed beverages that offer high-quality taste without the need for preparation.”

RTDs appeal to a wide range of demographics, Theriault adds, from millennials to Generation Z (aged 21 and up) seeking portable options for social gatherings, to time-strapped professionals looking for quick indulgence.

“The category’s flexibility has allowed it to expand into diverse flavor profiles and alcohol based, including spirits, wine and malt beverages, providing options that cater to evolving palates and lifestyles,” she says. “Ultimately, these RTD products, especially those with a spirits base, are in the repertoires of premium and super-premium spirits consumers.”

Innovation within the RTD category also pushing boundaries with seasonal and limited-edition releases that create excitement and urgency among consumers, Theriault says.

“NIQ data shows that 50% of innovation dollars in the category are spent in RTD,” she states. “Additionally, premiumization is making its mark, as brands elevate RTDs with craft-inspired recipes and high-quality ingredients.”

Facing the challenges

Beyond inflation, the premium beverages market is experiencing other trials.

“In no-alcohol beverages, where the price premium is tied to its perceived functionality, there’s a danger that the product does not do what it claims to do,” BMC’s Dilworth expresses. “Thus, when times get tougher, the daily deluxe smoothie at the juice bar may be one of the items cut from the budget.”

Relatedly, he says there might be a natural limit to what companies can charge for their beverages.

“The higher the price, the more inclined consumers are to do it themselves or change their behavior within the category,” Dilworth notes. “An example of the former is brewing one’s own kombucha. An example of the latter is switching from an imported to a domestic bottled water brand.”

In spirits, Dilworth states there is already a surfeit of celebrity-led brands, particularly in tequila. For example, earlier this year, rapper Megan Thee Stallion joined the celebrity tequila segment with the launch of her premium tequila brand, Chicas Divertidas.

“Although the wealthy will continue to purchase super-premium spirits no matter what the economy does, will there be enough buying among the non-wealthy to sustain all the existing premium and super-premium brands?” Dilworth asks.

Keychain’s Madoff says one big challenge for premium beverage brands is trust.

“As more brands enter the ‘premium’ space, people are more skeptical of marketing claims,” he shares. “It’s not enough to toss around buzzwords — consumers want benefits backed by real science. And behind the scenes, sourcing clean or ethically produced ingredients adds complexity and cost, which puts more pressure on margins and brand reputation.”

NIQ’s Theriault states that, in 2024, beverage alcohol struggled to achieve growth in value and volume shares.

“Retailers faced pricing pressure as beer saw a significant increase, coupled with consumer elasticity for price, which has impacted the volume pressures in all alcohol segments,” she says. “Total beer experienced -0.7% growth in value and a 4.4% decrease in volume sales. The only category in the positive was total spirits, with 0.2% growth in value and 1.8% in volume sales.”

This growth was largely fueled by RTDs, including seltzers, flavored malt beverages (FMBs), spirits RTDs and wine RTDs, Theriault explains.

Opportunities for growth

Premium beverages can support their growth in the years to come through a variety of methods.

BMC’s Dilworth says there seem to be tweaks that brand owners can make, such as lowering price points or unit prices, even if it means downsizing or multi-sizing packages.

“This has been seen in kombucha, where the standard 16-ounce glass bottle has been supplemented with 12-ounce cans, as well as with lower-unit-price 40-ounce glass bottles,” he notes. “Of course, there’s a danger in being perceived as engaging in too much shrinkflation, such as the 64-ounce package of orange juice that has dwindled to 46-ounces recently.”

There’s a lot of upsides if brands stay focused on real functionality and clear values, Keychain’s Madoff states.

“Products that support health goals while using real, high-quality ingredients and tell a transparent, values-driven brand story will continue to win,” he says. “There’s also growth potential in exploring new formats and technologies in the premium beverage space, as well as expanding into adjacent wellness categories. Ultimately, brands that stay nimble, honest and value-focused are well-positioned to thrive.”

Despite current declines across the industry, NIQ’s Theriault shares beverage alcohol is poised for opportunities in 2025, driven by shifting consumer preferences, technological advancements and emerging market segments.

“As consumers continue to seek premium moments in their consumption, ensuring diversified size offerings on premium products is key,” she says. “Another promising area lies in innovation within the moderation space. With more consumers prioritizing their health, non-alcoholic beer, wine and spirits, as well as low-ABV [alcohol-by-volume] options and functional offerings like adaptogenicc cocktails, are gaining traction.”

Brands that strategically invest in expanding their product lines to include such options can keep their loyal consumers closer to their trusted brands when they seek alternatives to alcohol consumption, Theriault notes.

“By leveraging these trends, companies can create products that resonate with evolving lifestyles while differentiating themselves in the market,” she explains. “Despite changes in consumption by moderation, alcohol tends to be the ‘affordable luxury’ and ‘treat occasion’ for many consumers.”

Theriault also urges beverage-makers to embrace digital transformation, which is a critical avenue for growth.

“Strength in click-and-collect may be the key differentiator between strong growth and tepid sales,” she says. “For brands that can harness the power of digital marketing and analytics, the opportunity to build personalized, long-lasting relationships with shoppers are immense, creating a foundation for sustained growth in the years to come.”